A bimetallic standard emerged under a silver standard in the process of giving popular gold coins like ducats a fixed value in terms of silver. The gold standard is a fixed monetary regime under which the government’s currency is fixed and may be freely converted into gold. With the resumption of convertibility on June 30, 1879, the government again paid its debts in gold, accepted greenbacks for customs and redeemed greenbacks on demand in gold. While greenbacks made suitable substitutes for gold coins, American implementation of the gold standard was hobbled by the continued over-issuance of silver dollars and silver certificates emanating from political pressures. Lack of public confidence in the ubiquitous silver currency resulted in a run on U.S. gold reserves during the Panic of 1893. The gold standard prevents inflation as governments and banks are unable to manipulate the money supply (e.g., overissuing money).

Conversely, nations with trade deficits saw their gold reserves decline as gold flowed out of those nations as payment for their imports. The gold standard in the U.S. and many other nations was replaced by fiat money. Fiat money is the currency of a government, which is not backed by a commodity but has value because the government has determined that it does and that it must be accepted as a form of payment. In the decades prior to the First World War, international trade was conducted on the basis of what has come to be known as the classical gold standard. Conversely, nations with trade deficits saw their gold reserves decline, as gold flowed out of those nations as payment for their imports.

Company

She has worked in multiple cities covering breaking news, politics, education, and more. Approximately 150 documents are divided into three sections that correspond roughly with the changing position of gold in the international economic system. Citations are provided for every source so as to facilitate the reader’s further research. These documents are therefore a valuable resource for researchers who seek even more in-depth knowledge of the history of money and gold. We then addressed some background information about self-directed Precious metals IRAs and provided some tips on how to make the best Gold IRA Investment. Recognize that these reviews are written by investors who interacted with the company in question and felt compelled enough by their experience to provide feedback.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. However, in general, perhaps the best way to protect yourself against counterfeit gold is to buy from a reputable dealer with a good track record. If you’re like thousands of Americans, you go to a gold party, the hottest trend on the block, where you can have your jewelry appraised and get paid cash on the spot. At the start of this obsession, gold was solely used for worship, demonstrated by a trip to any of the world’s ancient sacred sites.

Gold Standard System vs. Fiat System

If the bulk of your current investments are in cash in one form or another, converting some of that cash to gold can be beneficial. It’s a great way to round out your portfolio so you’re not entirely dependent on cash. Gold also adds stability to your other investments, which can give you added peace of mind. For instance, if your stocks aren’t doing so well, gold can be a much-appreciated asset. It’s bought and sold throughout the world, and though its value may change over time it’s always been considered a precious metal with a high monetary value. Once you’ve converted your wealth to gold, however, you’ll need to convert it back again to gain use of it in most areas.

Investors with limited funds will focus on the Gold IRA companies with the lowest minimum Investment. Regardless of which Precious metals you choose to hold in your Gold IRA you always want to get the most metal possible for each Investment you make. The primary commercial demand for Platinum and Palladium is for catalysts in automotive catalytic convertors. Less than 12% of Gold’s annual production is used in industry while approximately 78% of Gold production is used for jewelry. A regular Gold IRA allows you to defer income taxes on your retirement savings and a Roth Gold IRA allows you to avoid capital gains taxes on your retirement savings.

ETFs that own mining stocks

While the gold standard was not suspended, it was in limbo during the war, demonstrating its inability to hold through both good and bad times. This created a lack of confidence in the gold standard that only exacerbated economic difficulties. It became increasingly apparent that trading account english meaning the world needed something more flexible on which to base its global economy. With the gold standard, countries agreed to convert paper money into a fixed amount of gold. The statements made on this website are opinions and past performance is not indicative of future returns.

- In the following years, both Belgium and the Netherlands cashed in dollars for gold, with Germany and France expressing similar intentions.

- These documents are therefore a valuable resource for researchers who seek even more in-depth knowledge of the history of money and gold.

- The selections you make at this point can dramatically affect the value of your Gold IRA in both the immediate future and over the lifespan of the IRA.

- When economic times get tough or financial events such as the blow-up of Silicon Valley Bank throw the markets for a loop, investors often turn to gold as a safe haven.

- In general, gold has been considered a safe investment, so when there is a lot of volatility in the economy or the stock market, investors tend to prefer gold.

Stake.us are one of the most popular social casinos, if not the most popular. They offer players the chance to enjoy games for free on their site, but also give you the option to gain real-world prizes. To find out how the process works, you can read through our guide to Gold Coins and Stake Cash.

Gold Ounce

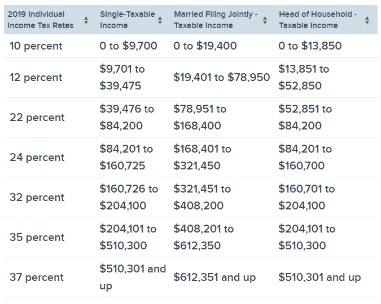

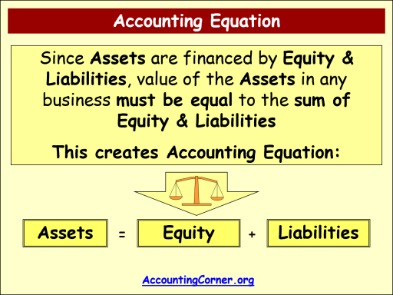

If you distribute the metal you will then be able to do with it as you please (while abiding by all IRS rules, of course). You can sell the Gold at the local Coin or pawn shop, bury it in the garden, give it to the grandkids, or ‘lose it in a boat accident’. You get all the same tax benefits from a Gold IRA as you do from a traditional IRA holding Stocks and Bonds. That means when it is time to take a distribution from your Gold IRA any capital gains will be taxed as ordinary income just like a Stock or Bond unless it is a Roth Gold IRA where capital gains are tax-exempt.

One of the largest drawbacks is the need to safeguard and insure physical gold. This gives investors a sense of security compared to cash assets (which can quickly become devalued) and stocks (which exist abstractly as shares or symbols on a screen). Gold is considered a highly liquid investment because it’s easy to buy and sell. You can buy gold in a number of ways, including ETFs, IRAs and futures.

These Coins aren’t appropriate for retirement savings because they carry very high premiums over the value of the Gold they contain and their prices are quite volatile. Silver is under $25 an ounce currently, Platinum is just over $1000, and Palladium is around $1500 (as of May 16, 2023). So we have three Precious metals that can’t be distinguished from one another yet one of them is significantly less expensive than the other two.

Paypal Mints Stablecoin – Global Finance

Paypal Mints Stablecoin.

Posted: Fri, 01 Sep 2023 17:00:45 GMT [source]

The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

What Countries Are on the Gold Standard Today?

That means you can transfer some or all of your existing IRA funds into a self-directed IRA where you can invest in alternative Investments using your tax-advantaged savings. Next, we’ll talk about self-directed IRAs and how they can be used to hold Real Estate and Precious metals. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.