This historic level amounts to a $162.9 billion investment in the small business economy – an $8.7 billion increase from the previous fiscal year. Ten federal agencies earned an “A+” for their agencies’ achievements in small business contracting, and an additional ten agencies received an “A” grade. The federal government, overall, earned an “A” on this year’s government-wide scorecard. A fiscal year is a 12-month period used by a business for reporting and planning. It may not align with a calendar 12 months and is usually chosen for reasons due to the nature of the business. For example, a company may choose to use a fiscal year to better reflect seasonal effects on the business, for tax reporting purposes, or to align with an academic calendar.

Most other countries begin their year at a different calendar quarter—e.g., April 1 through March 31, July 1 through June 30, or October 1 through September 30. In the United States, the government’s fiscal year begins on October 1, meaning that Q1 in the government’s fiscal year is October 1 to December 31, Q2 is January 1 to March 31, and so on. Macy’s Inc. (M) ends its fiscal year on the fifth Saturday of the new calendar year; in 2021, this date fell on Jan. 30. Many retailers generate a large chunk of their earnings around the holidays, which could explain why Macy’s chooses this end date.

Always Be Ready for Fiscal Year Reporting With Automated Accounting From NetSuite

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. For example, President Joe Biden and the Congressional members elected in November 2020 took office in January 2021. Companies that can use fiscal years which don’t coincide with calendar years can break their year up as they see fit to align with their industry. Among the inhabited territories of the United States, most align with the federal fiscal year, ending on 30 September. These include American Samoa, Guam, the Northern Mariana Islands and the U.S. Virgin Islands.[67] Puerto Rico is the exception, with its fiscal year ending on 30 June.

Fiscal years that vary from a calendar year are typically chosen due to the specific nature of the business. For example, nonprofit organizations typically align their year with the timing of grant awards. To maintain the quality and accuracy of contracting data, every federal agency takes responsibility for its own data. Simultaneously, the SBA conducts supplementary analyses to identify potential data anomalies.

- SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments.

- If your business is a partnership, S corporation, or personal services corporation, you may need to use IRS Form 8716 to change your tax year to a year other than the required tax year.

- A fiscal year may be referred to as a budget year or natural business year because it ends when sales or other activities are at a natural low point.

- While countries generally have a default fiscal year used by the government, they often allow individuals and organizations to employ different fiscal years based on their specific needs.

In addition to regular years, there are a number of different fiscal years. A fiscal year is the 12-month period a company uses for accounting purposes. Gaining such approval might be necessary if, for instance, the majority of partners use a fiscal year. In the United States, the Securities and Exchange Commission (SEC) requires publicly traded companies to file performance reports for fiscal years on Form 10-K. Corporate 10-Q and 10-K filings are maintained in the SEC’s EDGAR database.

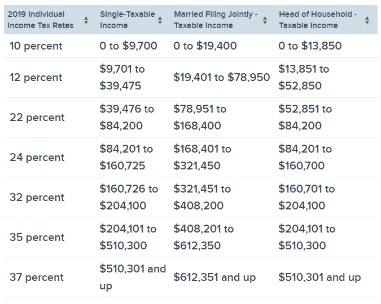

Tips for Managing Your Business

In 1800 the start of the tax year was moved forward one more day, to April 6. However, though April 6 remains the start of the tax year for individuals, the British government and British corporations operate on a tax and fiscal year beginning slightly earlier, on April 1. The default IRS system is based on the calendar year, so fiscal-year taxpayers have to make some adjustments to the deadlines for filing certain forms and making payments. While most taxpayers must file by April 15 following the year for which they are filing, fiscal-year taxpayers must file by the 15th day of the fourth month following the end of their fiscal year.

They are required by law to file their taxes by the 15th day of the fourth month after the close of their fiscal year. A company’s fiscal year is its financial year; it is any 12-month period that the company uses for accounting purposes. A fiscal year-end is usually the end of any quarter, such as March 31, June 30, September 30, or December 31. School districts typically have fiscal years of July 1 through June 30 to coincide with its natural business year. Large retailers often end their fiscal years on the Saturday closest to January 31 in order to include sales returns from its peak December sales. The retailers’ interim periods will be 13-week “quarters” consisting of one 5-week “month” plus two 4-week “months”.

Learn How NetSuite Can Streamline Your Business

While countries generally have a default fiscal year used by the government, they often allow individuals and organizations to employ different fiscal years based on their specific needs. The Committee recognizes that budget uncertainty due to temporary lapses of appropriations and continuing resolutions affects the orderly operations of critical health care programs for Native American communities. For example, in the United States, though the fiscal year begins in October, the tax year is usually the calendar year for individuals.

- School districts typically have fiscal years of July 1 through June 30 to coincide with its natural business year.

- Or they can designate an alternate fiscal year that best suits their accounting needs, such as one that closes after an expected increase in revenue.

- Additionally, you may have to request a ruling and pay a fee to get the ruling on your request for a different fiscal year.

- – The Fiscal Year 2024 Interior, Environment, and Related Agencies Appropriations Act provides $42.695 billion in total funding.

- Fiscal years provide companies with the ability to establish their accounting year in a way that presents an accurate picture that would be otherwise compromised by using calendar year cutoff.

For many businesses, using a 12-month fiscal year facilitates year-to-year data comparisons, as each year will have the same number of days. However, some businesses have strong weekly revenue patterns, and so it is more important to them to begin and end accounting periods on the same day of the week. For example, a movie theatre that does most of its business on Saturdays and Sundays may choose a 52-to-53 week fiscal year to ensure that most periods have the same number of weekend days and can be more easily compared. In the United States, eligible businesses can adopt a fiscal year for tax reporting purposes simply by submitting their first income tax return observing that fiscal tax year. However, companies that want to change from a calendar year to a fiscal year must get special permission from the IRS or meet one of the criteria outlined on Form 1128, Application to Adopt, Change, or Retain a Tax Year. A financial year equals 12 consecutive months during which a business tracks its finances for tax and reporting purposes.

Why Does My Company’s Fiscal Year Matter?

A corporation with a March 31 fiscal year-end may also file a corporate income tax return, effective March 31. You don’t have to select a tax year for you business; you can just file your first income tax return using that tax year. Fiscal year versus calendar yearA fiscal year is an accounting year that, unlike the calendar year, doesn’t necessarily end on Dec. 31. A fiscal year is essentially a customized 12-month period used for accounting purposes.

NIH releases Alzheimer’s disease and related dementias research … – National Institute on Aging

NIH releases Alzheimer’s disease and related dementias research ….

Posted: Mon, 31 Jul 2023 12:00:00 GMT [source]

The Internal Revenue Service (IRS) allows companies to be either calendar year or fiscal year taxpayers. As explained above, the reporting period can vary from one publicly traded company to another. However, even if two companies’ reporting periods do not align, it’s not impossible to make comparisons. In this case, you could then use the last twelve months, or trailing twelve months (TTM) metric to examine the activities of the last twelve months for both companies. In some cases, a company may choose to use fiscal year reporting simply to get a lower cost on tax preparation services.

Another benefit of following a fiscal year is the potential to save money on accounting and auditing fees. Because many companies and entities follow the calendar year for accounting and auditing purposes, tax and accounting professionals may be in high demand in the months leading up to Dec. 31. Companies that require audited financial statements therefore stand to benefit by operating under fiscal years that don’t end on Dec. 31, as doing so gives them increased access to accounting professionals and the ability to negotiate fees. When the country adopted the Gregorian calendar in 1752 to better align itself with other countries in Europe, there was a mismatch between the calendars of about 11 days. Great Britain consequently extended its 1752 tax year by 11 days, to end on April 4, to ensure that no revenue was lost as a result of the shortened calendar year.

Purdue research awards and philanthropic fundraising both new … – purdue.edu

Purdue research awards and philanthropic fundraising both new ….

Posted: Mon, 31 Jul 2023 14:44:24 GMT [source]

A fiscal year is a set one-year accounting period used for financial reporting and budgeting. For example, the U.S. government follows an Oct. 1 to Sept. 30 fiscal year so that newly elected officials can participate in the budget process. That said, many types of businesses, such as sole proprietors, limited liability companies and S corporations, must, by default, use the calendar year as their tax year unless they receive permission from the IRS to who we are change it. A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting period not aligning with the calendar year (1 January to 31 December).

Consequently, most large agriculture companies end their fiscal years after the harvest season, and most retailers end their fiscal years shortly after the Christmas shopping season. In the United States, the federal government’s fiscal year is the 12-month period beginning 1 October and ending 30 September the following year. The identification of a fiscal year is the calendar year in which it ends; thus, the current fiscal year is 2023, often written as “FY2023” or “FY23”, which began on 1 October 2022 and will end on 30 September 2023. Natalya Yashina is a CPA, DASM with over 12 years of experience in accounting including public accounting, financial reporting, and accounting policies. Companies can choose whether to use a calendar year or fiscal year for their reporting. Those choosing to follow a fiscal year may do so to better align with their industry, more accurately reflect seasonality, or because it makes sense for the nature of their business.

S corporations can use one of the permitted permitted tax years, but the calendar year is the only one you can use without filing an election. Additionally, the bill provides modest increases to support EPA grant programs like the Brownfields Program, U.S.-Mexico Border Program, and Wildfire Smoke Preparedness in Community Buildings Grant Program. In addition, the bill provides $81.6 million for staffing newly constructed facilities to ensure IHS has the health care providers to meet increased demand. Accountants are often busiest around the end of the calendar year, when many businesses are closing their books. Having a non-calendar fiscal year lets businesses negotiate deals on getting their own auditing done.

For example, a company might operate on a fiscal year that begins on Nov. 1 and ends on Oct. 31. Companies that follow a fiscal year must still adhere to IRS tax filing deadlines, which are based on the calendar year. Having the right fiscal year for your business can help you better understand your business’ financial performance over time. It may also help streamline and save money on your accounting, and could offer a more ideal tax deadline for your business. Before deciding between a fiscal year and a calendar year, consider your business’ budget and weigh all of your options.

The examples below from Allbirds (BIRD) and Microsoft (MSFT) show one such variation, with Allbirds using calendar-year reporting and Microsoft using fiscal-year reporting. The reason for this is to avoid having to face customers who are in a position to demand lower prices given that other companies with big sales targets are trying to close big deals at the same time. An additional example is educational institutions, which may align their fiscal year with the academic calendar. Companies that choose to report by fiscal year do so for different reasons, such as seasonality or timing. If you aren’t using a calendar year for your fiscal year, check with the accountant before answering this question.

Stock data websites may also report this alongside a company’s financials. 10-K filings are available on the investor relations page of any publicly traded company or on the Securities and Exchange Commission (SEC) site. Additionally, companies may choose to use a fiscal year to spare their employees the rush of closing the business year during the holidays, when many people take time off. Companies use a fiscal year to mark the start and end of their revenue and earnings for a set timeframe, which can then be used for reporting, analysis, comparisons, and more. Seasonal businesses also tend to use fiscal years for accounting purposes.